5-Stars rating on Google

"Educational self help tools. Not a law firm"

Don’t Let a Debt Lawsuit Turn Into a Judgment

Los Angeles & Orange County: Our affordable step by step kits help you respond on time, stay in control, and avoid the expensive “default judgment” outcome.

Fill in templates that show you what to file

Simple checklist so you don't miss steps

A clear plan that lowers stress in your home

100% money-back guarantee

Choose the Right Defense for Your Case

Our Values

Affordable & Transparent – Clear pricing, no surprise fees.

1

Peace of Mind – Know exactly what to do next when you’re facing a lawsuit.

2

3

Experience That Matters – Years of helping consumers fight back against unfair debt practices.

When the debt collector receives your Answer & your Motion to Compel Arbitration defense. You'll be well on your way to winning your case

You WIN!

TRUST & GUARANTEES

Why DIY Fix My Score Is the Safer, Smarter Choice

Clear promises, fast human help, and court-verified details—so you file with confidence and keep control of your case.

Credibility Checklist

Human help, fast. Live chat + email; deadline cases get priority escalation

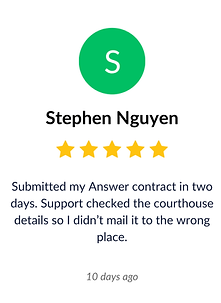

Court-verified details. We double-check court name, address, and e-file vs mail before you file.

Signature clarity. We confirm wet vs e-signature acceptance and including signing notes.

No surprises. Filing-fee calculation, clear pricing, and step by step serving guidance.

You stay in control. Polished PDF delivered to your email.

Our Promises

Response time. We reply within 1 business day; deadline-flagged cases same-day.

Court data check. Court info, case #, and delivery method verified pre-send.

Signature policy. Cover page includes court specific e-sign or wet sign guidance.

Rejection fix: If the clerk rejects for a formatting issue we control, we fix & resend free.

Understanding Debt Collection Lawsuits

Being served with a civil suit or creditor summons can feel overwhelming. Debt collectors and creditor attorneys often rely on fear and confusion to push consumers into quick judgments. A summons means that a creditor has taken legal action to collect on an account, and you are legally required to respond.

Typical debt collection lawsuits move fast — you may have only 20–30 days to reply, depending on your state. Ignoring the paperwork often leads to a default judgment, which gives creditors the right to garnish wages, levy bank accounts, or place liens on property.